I. Overview

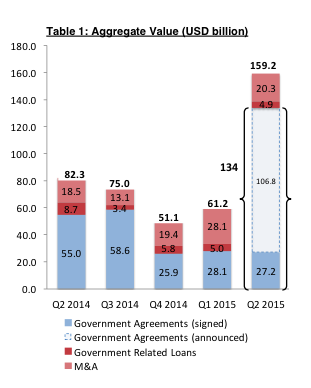

Q2 Chinese outbound investments totalled USD 159.2 billion, an increase of 160% over Q1 2015.

In M&A/equity, there was a 65.3% increase in volume (101 in Q1 versus 167 in Q2), but a 27.7% decline in aggregate value to USD 20.3 billion. This resulted in a decline in average transaction size from USD 278 million in Q1 to USD 122 million in Q2. This decline was related to both the rising volume of smaller tech/ecommerce investments in North America and the decline in the number of deals over USD 1 billion this quarter.

Government Related Loan Agreements outside of the more comprehensive Government Agreements announced this quarter were only 4 in number and totalled USD 4.9 billion, flat from Q1. The remaining 81% of the signed Government Related Loan Agreements in Q2 were within the much larger Government Agreements.

The leading component in Q2 was Government Agreements, which had announced aggregate values of USD 134 billion, only USD 27.2 billion of which were signed(1). This amount is more than double the amount of any of the past four quarters and greater than the combined total of the past three quarters. We not do recall any quarter during our past 7 years of publishing quarterly research with announced aggregate amounts of this magnitude.

As the quarter ended, the USD 100 billion, 57 country AIIB was officially launched to focus on infrastructure projects along One Belt, One Road. Only days before the AIIB launch, CITIC Group and its subsidiaries announced plans to provide both debt and equity of up to USD 115 billion for projects along One Belt, One Road over the next several years. Finally, in Q2, the previously launched USD 40 billion Silk Road Fund signed an equity agreement with ChemChina to help fund/complete the previously announced USD 8.9 billion (Enterprise Value) Pirelli acquisition. Clearly, China's firepower to deliver on its USD 134 billion pledged this quarter was substantially enhanced in Q2.

M&A / Equity Transactions

As noted above, Q2 announced outbound M&A aggregate value was USD 20.3 billion, down 27.7% from the USD 28.1 billion in Q1.While aggregate value decreased, volume increased by 65.3%, to 167 transactions. Part of the reason for the decline in aggregate value relates to the decline in the number of large transactions. This quarter there were only 5 transactions in excess of USD 1 billion and 10 in total over USD 450 million, representing 56.6% of aggregate M&A/Equity aggregate value. These amounts are down from 8 and 14 deals respectively and 80% of Q1 aggregate value.

Unlike the rest of the world, which saw numerous multi billion transactions announced this quarter, there were no Chinese outbound M&A deals greater than USD 2 billion announced this quarter. Instead, 69% of total volume represented transactions below USD 100 million. There were 23 announced transactions under USD 100 million (versus 18 in Q1), 24 under USD 50 million (versus 9 in Q1) and 69 under USD 25 million (versus 39 in Q1). Clearly unlike the multi-billion outbound deals of only a few years ago by large SOEs, this round of activity is much more middle market and/or rounds two or three within technology firms. We view this as a positive trend as outbound M&A now seems more widely accepted as a standard form of Chinese middle market international expansion.

Financials led in both volume (34) and aggregate value (USD 7.5 billion). Most of the activity in this sector was again centered around real estate, but there were also two sizeable insurance deals as well as a USD 1.5 billion commercial banking portfolio acquisition. Following Financials (37%) in aggregate values were Basic Materials (23%) and Technology (14%).

Technology deals were 2nd in volume (31) and 3rd in terms of aggregate value (14%), while Industrials were 3rd in volume but represented only 4% of aggregate value.

North America led again in volume with 64 announced transactions (38% of volume), followed by Asia with 56 (34%). Similar to the last several quarters, volume in North America was driven by investments in technology/ecommerce.

Relative to aggregate value, Asia ranked 1st with 32% while North America followed closely with 31%. Europe fell to 16% of total volume and 17% of aggregate value. Average transaction size in Europe was 40% higher than in North America due to its lack of activity in tech/ecommerce early round investments and the significant increase in overall M&A activity in North America and Asia as previously reported by various press.

Government Related Loan Agreements

There were 21 Government Led Loan Agreements signed this quarter, representing USD 19.6 billion aggregate commitments. Only 4 of these loans, representing signed commitments of USD 4.9 billion, were unrelated to major Government Agreements announced in Q2. However, these four loans were to African countries (Angola, Kenya, South Africa and Tanzania) which previously signed much larger Government Agreements with China. All four of these were in infrastructure, renewable energy or trade finance (to fund the purchases of China built locomotives in upgrading South African railways). The remaining 17 loans signed in Q2 are included within the major Government Agreements section.

As such, all 21 Government Related Loans signed in Q2 were 100% correlated with either Q2 announced or prior Chinese Government Agreements.

Government Agreements

The highlight of the quarter was the explosive growth within the Government Agreements component, which totalled USD 134 billion(1). There were major agreements signed with Governments along the One Belt, One Road and members of the newly launched AIIB including Pakistan, India, Belgium, Russia and Belarus. Planned contracts within these 5 countries totalled USD 103 billion this quarter. In addition, China is now contemplating building a 3,300 mil high speed railway across Latin America. Agreements with Brazil, Chile and Peru, three important countries along this planned railway route, totalled USD 30.6 billion this quarter.

II. Quarterly Feature: Government Led Agreement Calculations Refinements

In the M&A/equity and Government Related Loan Agreements segments, our firm has historically applied standard investment banking techniques of including transactions only after they have been signed and announced (and not at the stage of Memorandum of Understanding or Heads of Agreement). This has not been possible in the Government Agreements segment, as we felt compelled to include the official numbers produced by the Chinese Government and their counterparties when such Agreements were announced.

However, there are studies which show that China has not always delivered on what was announced within such Government Agreements previously. While we are very comfortable with our conclusions within the analysis of the 67 policy loans signed between 1st January 2014 through 31st March, 2015, we wanted to highlight a couple of other loans prior to the One Belt, One Road launch which demonstrate the complexities related to implementing these often large infrastructure projects and how the announced numbers do not always materialise.

Tanzania Port (2013 – 2015YTD)

-

March 2013 – China and Tanzania signed a package of 16 agreements, the largest of which was to build a new port (Bagamoyo) in Tanzania involving USD 10 billion investment/loans from China.

-

May 2013 – framework agreement signed between Tanzania and China Merchants Group (CMG) to carry out the construction of the port as well as the railway network leading to it. The agreement specified that USD 500 million would be designated for port financing for 2013 (via CEXIM), for interest free or low interest loans to get the project started.

-

October 2014 – Oman's SWF, State General Reserve Fund, signed an agreement to take an equity stake in the venture. Construction, led by CMG, is scheduled to commence in July 2015 (this was the 1st time a specific date was announced).

-

March 2015 – confirmation by CMG, Oman's GSRFund and Tanzania's Prime Minister that the cornerstone will be laid in July 2015 in the now USD 11 billion project.

Malaysian Renewable Energy (2010 – 2014)

In 2010, China’s State Grid committed to invest USD 10 billion into Malaysia – in what appeared to be in different projects. Since then, the following subsequent developments on this pledge have occurred:

-

There were to be renewable energy/infrastructure projects to build four dams, Baram Dam, Murum Dam, Bakun Dam and Baleh Dam. The contract value of Murum Dam and Bakun Dam was RMB 5.8 billion (USD 870m) and RMB 3.3 billion (USD 398m) respectively. The contract value of Baram Dam and Baleh Dam was not disclosed.

-

Only the Murum Dam, through Three Gorges (operational 2014) and the Bakun Dam, through SinoHydro (operational 2010) were actually completed (aggregate value USD 1.3 billion).

-

Baram Dam (one of the 2010 projects to be led by SinoHydro) was put on hold while Baleh Dam is still under negotiation.

-

In addition to these 2 dams, there were 2 additional credit agreements signed since 2010 between China and Malaysia, a USD 322.7 million credit facility in January 2013 between the two Governments and a USD 3 billion joint investment by CEXIM and Malaysian Government in town-development in June, 2014.

-

So in this particular package, only USD 1.3 billion was actually utilised for the infrastructure projects, although there was an additional USD 1.8 billion commitments to Malaysia 3-4 years later: clearly well below the planned USD 10 billion, and clearly with different usage.

As a result of the above, we have decided to include two statistics within this segment commencing this quarter: officially announced amounts (as we have done historically) and specific amounts which have been signed this particular quarter. For example, in Q2, we found only USD 27.2 billion of the announced USD 134 billion where official contracts have been signed and values disclosed. As such, we will use both sets of numbers within this segment of our research going forward, as well as monitor actual flows into the major announced projects over the construction period for our database.